Content

While the basic definition of “nexus” means having a “substantial physical presence” in a state, internet-based commerce has driven changes to how this concept is interpreted. The company’s employees administer the SaaS services, and delivery of performance obligations cannot occur by the customer or a third party.

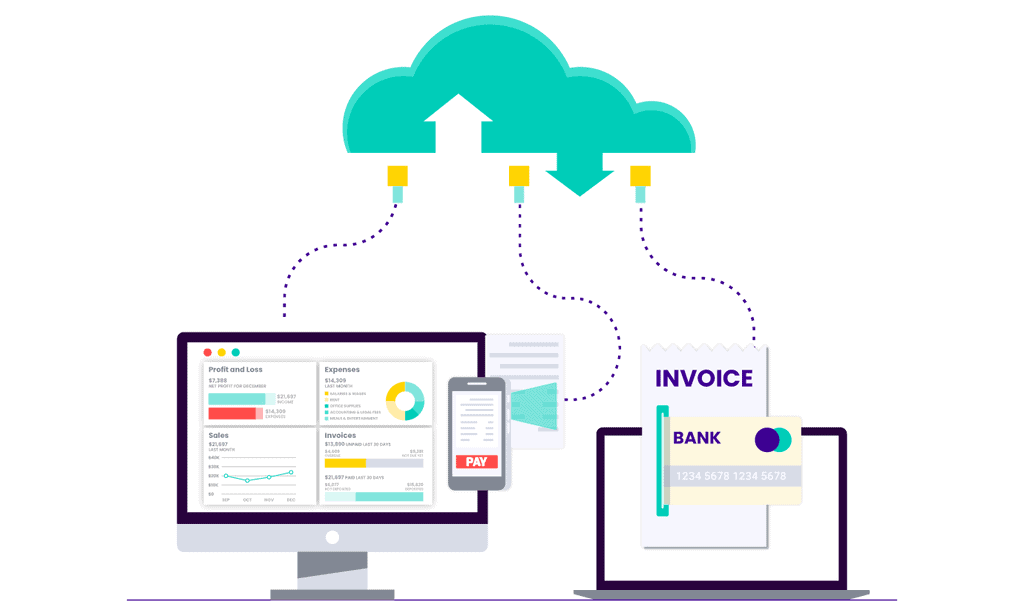

One of the biggest mistakes that SaaS Companies often make is its failure to save resources and accurately track company expenses following the agile payment principles. If you select inappropriate software, you risk your company bookkeeping and accounting. Consequently, you won’t have accurate records of company financials. No entrepreneur wants to waste their time dealing with accounting issues, so you need a one-stop solution to all your problems. With automation, you can focus more on the core business than bookkeeping and accounting. QuickBooks allows you to access almost all types of accounts, including but not limited to savings account, checking account, credit card accounts, and money market accounts. Furthermore, using Dancing Numbers saves a lot of your time and money which you can otherwise invest in the growth and expansion of your business.

Key Elements of SaaS Accounting

You can use the Direct Connect Option by enrolling for the Direct Connect service which will allow you access to the small business online banking option at bankofamerica.com. This feature allows you to share bills, payments, information, and much more. Using the PayPal mobile app, sending money internationally is simple.

Stripe, Paypal, Braintree, Checkout.com, GoCardless, and 27 other payment gateways. Investors, financial institutions, and the IRS want to the accurate financial records of a company and have a clear understanding and scope of a company’s financial numbers.

The transaction price must be defined

So far, we have discussed a myriad of automated tools that can assist SaaS companies to manage their accounting tasks. If you were confused before which software best suits my business, I sincerely hope this article will provide you with an in-depth understanding of each software. While you are tracking the sales of your specific product or a subscription service, you should consider using Sush.io. It brings all the automatically generated sales invoices and verifies them with the Stripe transactions. This isn’t a helpful option if you are expecting synchronization with Xero. If you want to integrate recifest other software, you should go with the $39 per month subscription plan.

When service is remitted successfully to the customer, and the billing is paid for the booking, income is earned, which is revenue. The money is considered earned as the customer’s contract is realized month by month, especially in the case of those who sign up for annual installments. HaTt annual fee is spread throughout the year, as goods and services are provided to the customer.

Top 7 Accounting software for startups

On the other hand, a balance sheet outlines what a business owes and what it’s owed. It does so by reporting the assets, liabilities, and shareholders’ equity. This model is advantageous in the Saas Accounting With Flare At Sleetercon sense that your business can betterforecast revenueand expenses. Although complicated compared to cash-basis accounting, accrual accounting can better serve quickly growing SaaS businesses.

- The benefits of cloud computing are considerable, and recent accounting changes have made cloud solutions even more attractive to many businesses.

- In addition, accurate reports and bookkeeping lead to financial transparency and provide relevant feedback so that businesses can make proactive decisions based on precise information.

- Current technology and software development processes now largely follow an agile development life cycle.

- Gusto is a platform made to make it simple for businesses to hire, pay, protect, and support their team members.

- The contract should explicitly define what services are offered, the period of providing these services, and the rights and obligations of each party.

As the money is earned, that portion of cash moves from deferred revenue to revenue, thus avoiding any miscalculations or potentially spending the money before it is earned. In this way, SaaS businesses can account for money flow and accurately account for what is recognized revenue . This is another accountancy solution that helps high-growth businesses with their financial evaluation needs.