Leasing, a contractual arrangement where one party allows another to use property or real estate in exchange for payment, is a versatile financial tool. In these agreements, the lessor, who owns the property, and the lessee, who uses it, outline the specifics of their arrangement. Let’s delve into the different types of leasing and understand their nuances.

Did You Know About Finance Leases?

Often encompassing the full economic life of an asset, a finance lease, or capital lease, is a robust form of leasing. Here, the lessor aims to recoup the asset’s cost plus a reasonable return through lease payments over the lease term. Being generally non-cancellable, it places the responsibility of asset maintenance squarely on the lessee.

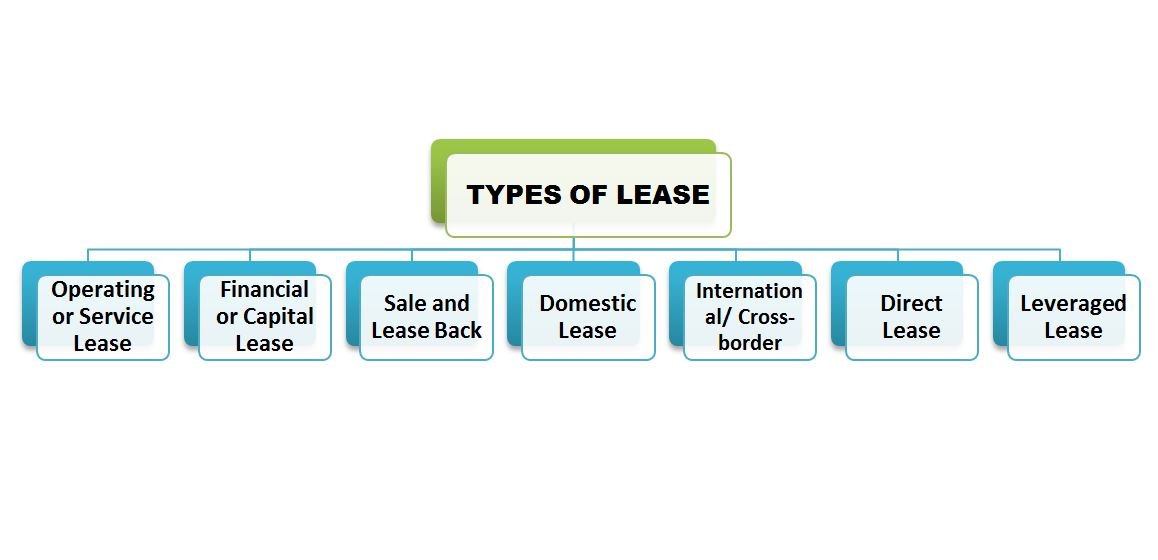

Exploring the Types of Leasing

The world of leasing is diverse, including finance leases, operating leases, leveraged and non-leveraged leases, to name a few. Let’s explore these varied types of leasing.

Finance Lease

In a finance lease, the lessor transfers most risks and rewards of asset ownership to the lessee. It’s akin to the lessee owning the asset, with the lease split into two phases. The primary, non-cancellable phase allows the lessor to recover their investment, followed by a secondary phase with significantly reduced rent.

Operating Lease

An operating lease is a flexible arrangement where the lessee uses the property for a set period. Either party can terminate the lease with notice. Here, the lessor covers all costs, doesn’t recover the full cost of the asset, offers specialized services, and suits situations where equipment may quickly become obsolete.

Leveraged Lease

In a leveraged lease, the lessor partially finances the asset purchase through loans, using the asset and lease payments as collateral. The lessor plays a role of an ownership participant, contributing only part of the asset’s cost, while lenders finance the rest.

Conveyance Lease

A conveyance lease is long-term, with the explicit intention of transferring ownership of the property to the lessee.

Sale and Leaseback

In this arrangement, a property-owning corporation sells it to a lessor, who then leases it back to the seller. The selling company retains usage of the asset while transferring ownership to the lessor.

Complete and Non-Pay-Out Lease

A full pay-out lease involves leasing the asset’s full value, while in a non-pay-out lease, the lessor can lease the same asset multiple times.

Specialized Service Lease

Here, the lessor, an expert in the asset, not only leases it but also provides personalized services to the lessee. Common examples include electronics, vehicles, and air conditioners.

Net and Non-Net Lease

In a non-net lease, the lessor handles maintenance and other incidental costs. Conversely, in a net lease, the lessor focuses only on financial services, leaving maintenance to the lessee.

Sales Aid Lease

This refers to a lease where the lessor partners with a manufacturer for promotional purposes.

Cross Border Lease

Cross-border leasing involves leasing transactions across national boundaries, common in shipping and aviation.

Tax Oriented Lease

This type of lease is recognized as a lease agreement rather than a loan secured by collateral.

Import Lease

In an import lease, the leasing company may be based abroad, with the lessor and lessee from the same country. Often, the leased equipment is imported.

International Lease

Similar to a cross-border lease, international leasing involves parties from different countries.

Types of Leasing in the Commercial Realm

Commercial leases vary, each with distinct terms and conditions. Let’s explore the primary forms found in India and what makes each unique.

Gross Lease

Also known as a full-service lease, the gross lease is where the landlord bears all property-related expenses. This arrangement, common in multi-tenant buildings, allows tenants to focus solely on their business, free from concerns about property expenses.

Benefits of Gross Lease

The main advantage for tenants is the exclusion of additional costs for insurance, taxes, or maintenance. This clarity and simplicity make it a preferred choice for many businesses.

Drawbacks of Gross Lease

However, gross lease rates can be higher than net leases, potentially deterring some businesses.

Net Lease

A net lease adds a twist: tenants pay not only the rent but also a portion of property expenses. These can include taxes, insurance, and maintenance costs.

Advantages of Net Lease

Landlords gain the flexibility to manage property expenses more effectively. If maintenance needs are low or property taxes decrease, they can benefit financially.

Disadvantages of Net Lease

For tenants, this lease type can pose financial risks due to unpredictable additional expenses.

Modified Gross Lease

Combining elements of both gross and net leases, the modified gross lease offers a more balanced approach. Tenants and landlords can negotiate which expenses are included in the rent, offering greater flexibility.

Benefits of Modified Gross Lease

Tenants enjoy more control over costs directly affecting their business, potentially leading to savings through efficient practices.

Disadvantages of Modified Gross Lease

However, fluctuating costs can impact the financial stability of smaller businesses or startups.

Conclusion: Understanding Lease Agreements

Lease agreements form the legal backbone of the relationship between lessor and lessee. They outline the rights, responsibilities, and potential penalties for breach of contract. Notably, leases typically require the lessee to handle utility costs. While some leases offer fixed terms, others allow for early termination. Regardless of type, an original copy of the lease agreement should always be kept for records and reference, ensuring both parties can address disputes effectively.