As the sector of finance continues to evolve, two awesome paths have emerged: Decentralized Finance (DeFi) and Traditional Finance (TradFi). Each offers specific possibilities and affords its own set of demanding situations. Understanding the differences among those systems is vital for all people seeking to navigate the monetary panorama, in particular as digital belongings like Bitcoin turn out to be greater regular. This article explores the possibilities and demanding situations associated with both DeFi and Traditional Finance, with a focal point on how gear like a Bitcoin Wallet suit into this evolving photograph.

What is DeFi

Decentralized Finance, or DeFi, refers to a brand new paradigm of monetary structures built on blockchain technology. It eliminates intermediaries like banks and brokers by utilizing clever contracts, which might be self-executing contracts with the phrases of the settlement directly written into code. DeFi programs aim to democratize access to financial services, making it viable for everybody with an internet connection to participate in sports consisting of lending, borrowing, trading, and income interest on belongings.

What is Traditional Finance

Traditional Finance (TradFi), alternatively, refers back to the conventional monetary systems that have been in place for hundreds of years. These systems are centralized, which means that they’re managed with the aid of financial institutions like banks, governments, and regulatory bodies. TradFi includes services which include savings bills, loans, mortgages, inventory buying and selling, and more. While these structures are well-mounted and regulated, they regularly include barriers along with excessive prices, sluggish processing instances, and confined access for sure populations.

Opportunities in DeFi

- Accessibility: DeFi structures are reachable to every body with an internet connection, removing limitations related to geography, socio-financial fame, and political surroundings.

- Lower Costs: By eliminating intermediaries, DeFi reduces transaction charges and different fees related to traditional banking services.

- Innovation: DeFi is a hotbed for monetary innovation, with new services and products being evolved at a fast tempo. From yield farming to decentralized exchanges, DeFi is constantly pushing the limits of what’s possible in finance.

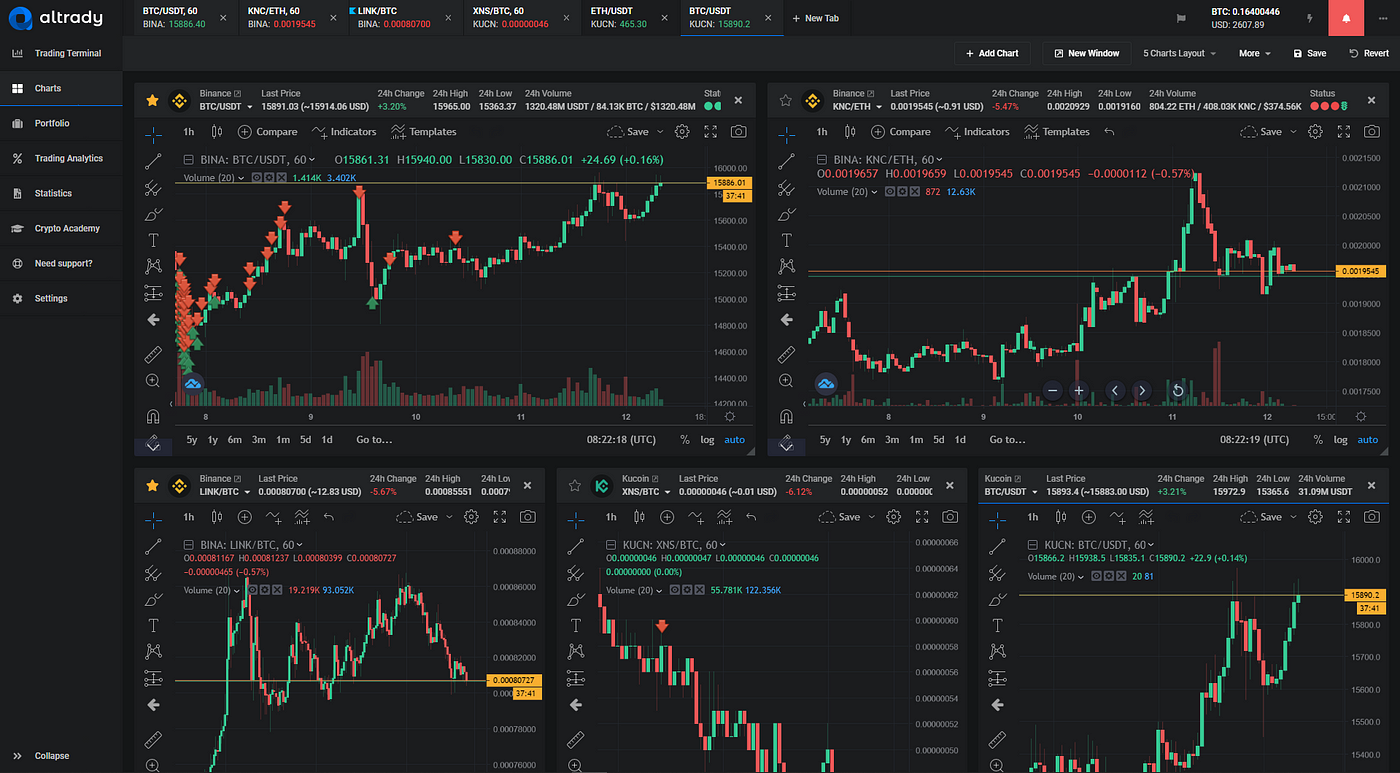

- Control and Ownership: DeFi users have complete control over their property. With equipment like a Bitcoin Wallet, customers can keep, control, and exchange their cryptocurrencies without counting on a third celebration.

Challenges in DeFi

- Security Risks: Despite its benefits, DeFi isn’t without dangers. The absence of intermediaries means that customers are fully liable for the security in their assets. Hacks and scams are not unusual, and once finances are misplaced, they may be regularly unrecoverable.

- Regulatory Uncertainty: DeFi operates in a regulatory gray region. While this permits for speedy innovation, it additionally poses risks. Governments may impose new guidelines that could restrict the boom and adoption of DeFi.

- Complexity: The DeFi surroundings can be complex and intimidating for inexperienced persons. Understanding the way to use platforms, secure property, and manage dangers calls for a steep studying curve.

Opportunities in Traditional Finance

- Stability: Traditional Finance is sponsored with the aid of set up establishments and regulatory frameworks, imparting a degree of balance and safety that DeFi currently lacks.

- Regulation and Oversight: While regularly seen as a downside, regulation in Traditional Finance also affords client protections that aren’t but found in DeFi. These guidelines can prevent fraud, guard deposits, and make certain the steadiness of the financial gadget.

- Accessibility for Non-Tech Savvy Users: Traditional financial structures are usually more handy for those who aren’t familiar with blockchain era or digital assets. Banking apps and services are designed to be consumer-friendly and intuitive.

Challenges in Traditional Finance

- Limited Access: Many people round the sector lack admission to standard monetary services due to geographical, political, or socio-financial obstacles.

- High Costs: Intermediaries in Traditional Finance, which includes banks and brokers, frequently price high expenses for their offerings. These costs can upload up, particularly for pass-border transactions.

- Slow Processes: Traditional financial structures regularly involve sluggish processing times, specially for international transfers or complex economic transactions.

The Role of a Bitcoin Wallet

In both DeFi and Traditional Finance, the concept of a Bitcoin Wallet is becoming increasingly more important. A Bitcoin Wallet is a digital tool that permits users to store, send, and receive Bitcoin and other cryptocurrencies. In DeFi, a Bitcoin Wallet is crucial for interacting with decentralized packages (dApps) and managing virtual assets. Users have full manipulation over their private keys, that means they own and control their cryptocurrencies.

In the context of Traditional Finance, Bitcoin Wallets have become extra applicable as institutions start to combine cryptocurrencies into their services. For instance, some banks now permit clients to buy, promote, and maintain Bitcoin without delay within their banking apps. However, these services are nonetheless in their infancy, and the level of management and possession offered by a conventional financial institution differs drastically from that of a DeFi wallet.

Choosing Wisely in Finance

The debate among DeFi and Traditional Finance is ongoing. Each gives unique opportunities and challenges, with the first-rate choice depending on man or woman needs. DeFi brings innovation, decrease costs, and greater accessibility however additionally dangers like security and regulatory uncertainty. Traditional Finance gives balance, regulation, and ease of use but may be expensive and restricting. As virtual belongings like Bitcoin grow in significance, gear like a Bitcoin Wallet becomes vital in both systems. Whether you discover DeFi or stick with Traditional Finance, knowledge of those elements will help you make knowledgeable choices within the rapidly evolving monetary landscape.