Best Tools for Tracking Bitcoin Price Charts

Bitcoin’s price can change in the blink of an eye, making it crucial to stay on top of every movement. Whether you’re a seasoned investor or just dipping your toes in, the right tools can be your best ally. From AI-driven analysis to mobile-friendly trackers, mastering these tools could be the difference between profit and loss in the crypto game. the-wealthcatalystai.com connects traders with experts who guide them in selecting the best tools for tracking Bitcoin price charts.

AI-Powered Bitcoin Chart Analysis Tools

When it comes to analyzing Bitcoin charts, AI tools are like having a smart assistant by your side. These tools help you make sense of all the numbers and graphs, predicting where Bitcoin prices might go. Imagine trying to spot patterns in thousands of data points—AI can do this quickly and more accurately than the human eye.

AI tools use algorithms that learn from past price movements. They can predict trends and even suggest when to buy or sell based on those patterns. For example, tools like CryptoHopper or Coinrule offer AI-based strategies that adapt to market conditions. They’re a bit like those fancy, self-adjusting glasses that adapt to the light around you, making your vision sharper.

But, as with any tech, AI tools aren’t foolproof. They analyze data based on past behavior, but the crypto market can be unpredictable. That’s why it’s always a good idea to combine AI insights with your own research and gut feeling. It’s like cooking—AI gives you the recipe, but you decide how much spice to add.

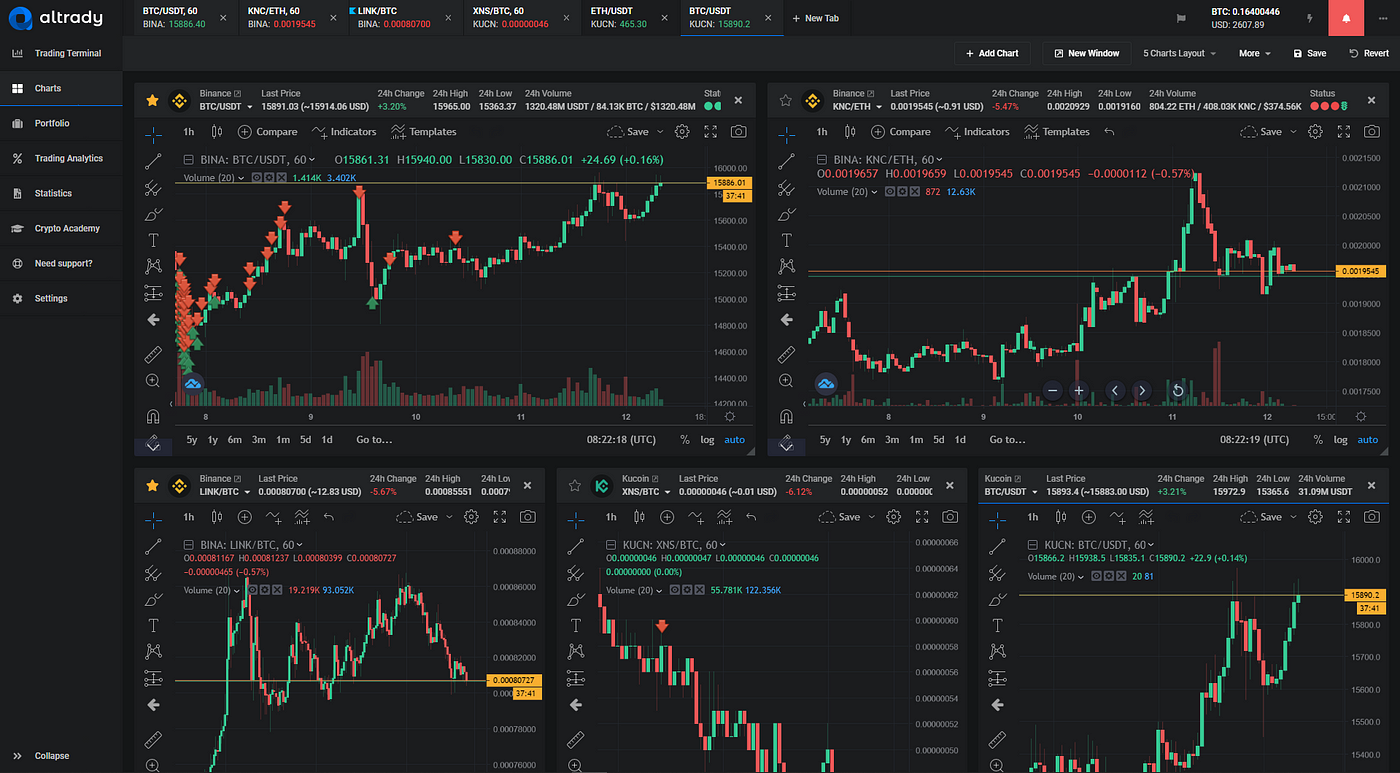

Comprehensive Multi-Currency Support: Tracking Bitcoin Alongside Other Cryptos

If you’re juggling multiple cryptocurrencies, a tool with multi-currency support is a game-changer. It’s like having a dashboard that shows you everything you need to know in one place. You can see how Bitcoin is doing, but also keep an eye on other coins like Ethereum, Ripple, or Litecoin.

Why is this important? Well, in the crypto world, the value of one coin can impact another. For instance, a big drop in Bitcoin might pull down the prices of other cryptos. A multi-currency tool helps you spot these connections. Platforms like CoinGecko or Delta are great examples—they let you track several cryptos at once, offering a complete picture of your investments.

But don’t just stop at tracking. Use these tools to compare how different coins are performing. This way, you can decide if you want to diversify your investments or focus on just one or two coins. Think of it as balancing your breakfast—maybe you want some eggs (Bitcoin), but also some toast (Ethereum) and a bit of fruit (Ripple) on the side.

Technical Analysis Platforms with Advanced Charting Capabilities

For those who love diving deep into numbers, technical analysis platforms are a must. These platforms offer advanced charting tools that let you study price trends, patterns, and more. It’s like being able to zoom in on every detail of a painting to understand the artist’s technique.

Using these tools, you can apply indicators like Moving Averages, Bollinger Bands, or the Relative Strength Index (RSI). Each of these helps you see different aspects of Bitcoin’s price movements. For example, Moving Averages smooth out price data to show trends over time, while Bollinger Bands help you understand market volatility.

TradingView is a popular platform for this kind of analysis. It allows you to customize charts, add multiple indicators, and even share your findings with other traders. But, remember, while these charts can give you a lot of insights, they’re not a crystal ball. Think of them as your map—useful, but you still need to keep your eyes on the road.

Mobile-Friendly Bitcoin Price Trackers for On-the-Go Monitoring

In our fast-paced world, who has the time to sit in front of a computer all day? That’s where mobile-friendly Bitcoin price trackers come in. These apps let you monitor Bitcoin prices no matter where you are—whether you’re waiting for your coffee or taking a break from work.

Apps like Blockfolio or CoinStats offer real-time updates and alerts. Imagine you’re out with friends, and suddenly, Bitcoin hits a price target you’ve been waiting for. With these apps, you get a notification right on your phone, so you can act quickly. It’s like having a little bird on your shoulder, whispering crucial news in your ear.

But convenience comes with its own risks. Mobile apps can be less secure if you’re not careful. Always use strong passwords, enable two-factor authentication, and be cautious about where you download your apps from. Remember, it’s better to be safe than sorry, especially when your investments are at stake.

Conclusion

Staying ahead in the volatile world of Bitcoin isn’t just about luck—it’s about using the right tools at the right time. By leveraging AI, multi-currency platforms, advanced charting, and mobile apps, you can make smarter decisions. Remember, a well-informed strategy is your best defense against the unpredictable tides of cryptocurrency trading.