In the ever-evolving world of cryptocurrency trading, investors are constantly on the lookout for opportunities to maximize their profit potential. One such avenue that has gained significant attention is the ETH/USDT trading pair.

So let us delve into the possibilities presented by this pairing, particularly in the context of ETH USDT futures, crypto futures trading, and the broader landscape of crypto trading platforms you can check them out here.

Understanding the ETH/USDT Trading Pair

The ETH/USDT trading pair represents the exchange rate between two prominent digital assets: Ethereum (ETH) and Tether (USDT). As the second-largest cryptocurrency by market capitalization, Ethereum offers a solid foundation for potential growth and stability.

On the other hand, Tether, a stablecoin pegged to the value of the US dollar, provides traders with stability and a hedge against market volatility. The combination of these two assets creates a trading pair that combines the potential for substantial gains with a certain level of stability.

Exploring ETH USDT Futures

One exciting development within this space is the introduction of ETH USDT futures. Futures contracts enable traders to speculate on the future price movements of Ethereum against Tether.

By leveraging futures contracts, investors can take advantage of both upward and downward price trends, thereby amplifying their potential profits. ETH USDT futures present an opportunity to capitalize on price fluctuations, regardless of the market conditions, making it an attractive choice for both seasoned traders and newcomers.

The Rise of Crypto Futures Trading

The broader domain of crypto futures trading has witnessed substantial growth and popularity due to its ability to provide greater flexibility and enhanced trading options.

With the advent of ETH USDT futures, traders can not only go long (betting on a price increase) but also go short (betting on a price decrease) on the ETH/USDT pair. This capability offers traders the potential to profit from both bullish and bearish market trends, thereby expanding their profit potential even in volatile market conditions.

The Role of Bitcoin Futures

While Bitcoin futures have traditionally dominated the crypto futures market, the emergence of ETH USDT futures signifies the growing prominence of Ethereum in the crypto space.

Ethereum’s innovative blockchain technology, coupled with its expanding relevance and influence, provides traders with diverse opportunities to diversify their portfolios beyond Bitcoin. This shift opens up new avenues for profit potential, allowing traders to explore multiple avenues within the crypto market.

Choosing the Right Crypto Trading Platform

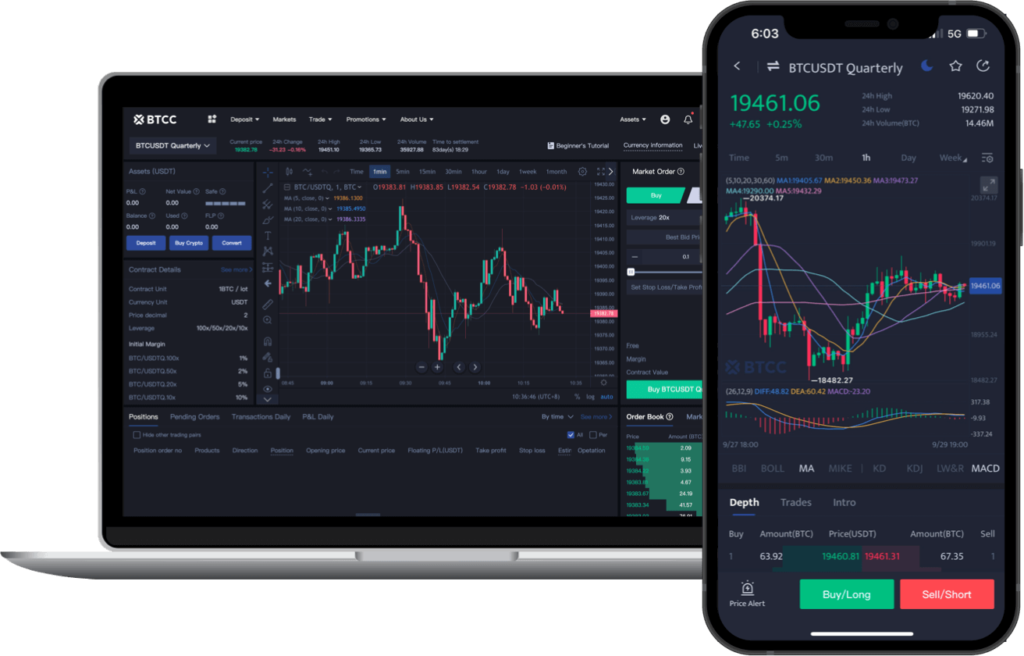

To fully leverage the opportunities presented by ETH USDT futures, it is crucial to select a reliable and user-friendly crypto trading platform. Leading platforms now offer a seamless trading experience with advanced features tailored specifically for futures trading.

These platforms provide real-time market data, charting tools, and efficient order execution capabilities, empowering traders to make informed decisions and execute trades swiftly. With the right crypto trading platform, traders can capitalize on the potential of ETH USDT futures and navigate the market with confidence.

The introduction of ETH USDT futures, alongside the broader realm of crypto futures trading and advanced bitcoin trading platforms, equips traders with the necessary tools and flexibility to navigate the market successfully.